us exit tax form

Prep E-File with Online IRS Tax Forms. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home.

Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854.

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

. If you file your taxes by paper youll need copies of some forms instructions and worksheets. There are three 3 tests a taxpayer can use to determine whether or not they fall into the category of covered. Citizenship or long-term residency by non-citizens may trigger US.

Get Tax Forms and Publications. Order by phone at 1-800-TAX-FORM 1-800-829. Citizen renounces citizenship and relinquishes their US.

Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Even if you may be considered a Long-Term Resident or US Citizen that does not mean you will be subject to the exit tax. The exit tax process measures income tax not yet paid and delivers a final tax bill.

Legal Permanent Residents is complex. Green Card Exit Tax 8 Years. Exit Tax and Expatriation involve certain key issues.

But if you are a Green Card holder and have only had it for. Relinquishing a Green Card. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Rather in order to become subject to the exit tax you must be a covered expatriate. Tax Guide for Aliens contains more thorough information on Expatriation Tax. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax.

The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long-term resident. Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. You are considered a long-term resident if you have been a US green card holder for eight of the past 15 years.

For eligible plans US expatriates may be subject to a 30 US tax rate on all taxable payments which is to be deducted and withheld by the. Download them from IRSgov. Became at birth a citizen of the US.

The exit tax in the US is a tax that may apply to US citizens or long-term residents who terminate their US citizenship or residency if they are considered covered expatriates. It is also required for long-term permanent residents who held their green card in at least 8 of the last 15 years. The Form 8854 is required for US citizens as part of the filings to end their US tax residency.

The exit tax in the US is the last chance for the IRS to. About Form 1040-NR US. Get Federal Tax Forms.

Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual Expatriation Information Statement for tax purposes. The expatriation tax consists of two components. Ad IRS-Approved E-File Provider.

THE UNITED STATES EXIT TAX 5 a. And another country and as of the expatriation date contin-ues to be a citizen of such other country and taxed as a resident of such country. Green Card Exit Tax 8 Years Tax Implications at Surrender.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. The general proposition is that when a US. Over 50 Milllion Tax Returns Filed.

Paying exit tax ensures your taxes are settled when you. Is there an exit tax in the US. Exit taxes can be imposed on individuals who relocate to another country as well as on businesses that have operations in multiple countries.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. Online Federal Tax Forms. Generally if you have a net worth in excess of 2 million the exit tax will apply to you.

The Basics of Expatriation Tax Planning. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to. Would not have been considered a resident of the US.

Assembly Bill 2088 AB 2088 which was introduced in Sacramento in August of 2020 would impose the states first wealth tax. You will also be taxed on all your deferred compensation. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card.

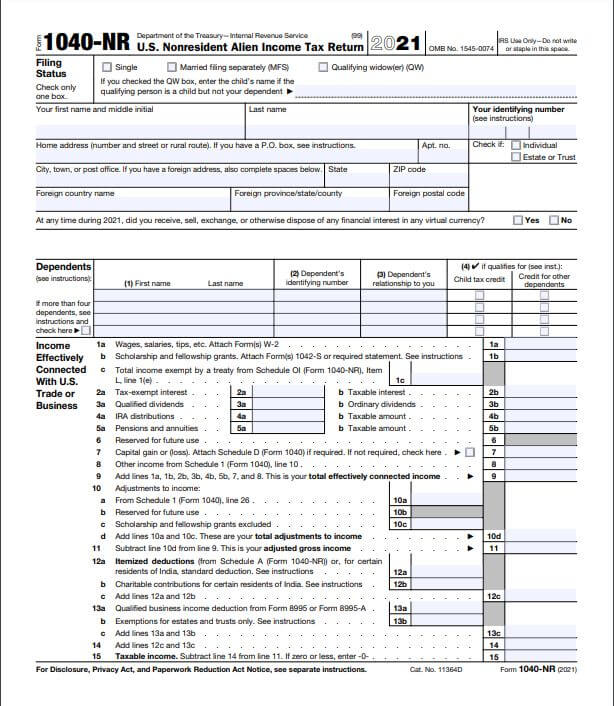

IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US. In this first of our two-part series we explain some of the. Nonresident Alien Income Tax Return About Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b Page Last Reviewed or Updated.

Exit taxes are typically calculated based on the value of the assets that are being. Under the substantial presence test of IRC. Get the current filing years forms instructions and publications for free from the Internal Revenue Service IRS.

The payor is a US person or foreign person who elects to be treated as a US person for this purpose The covered expatriate provides the payor with Form W-8CE within 30 days of their date of expatriation. The IRS Green Card Exit Tax 8 Years rules involving US.

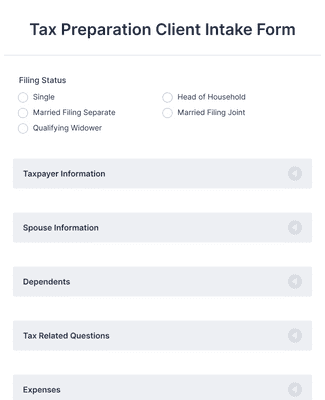

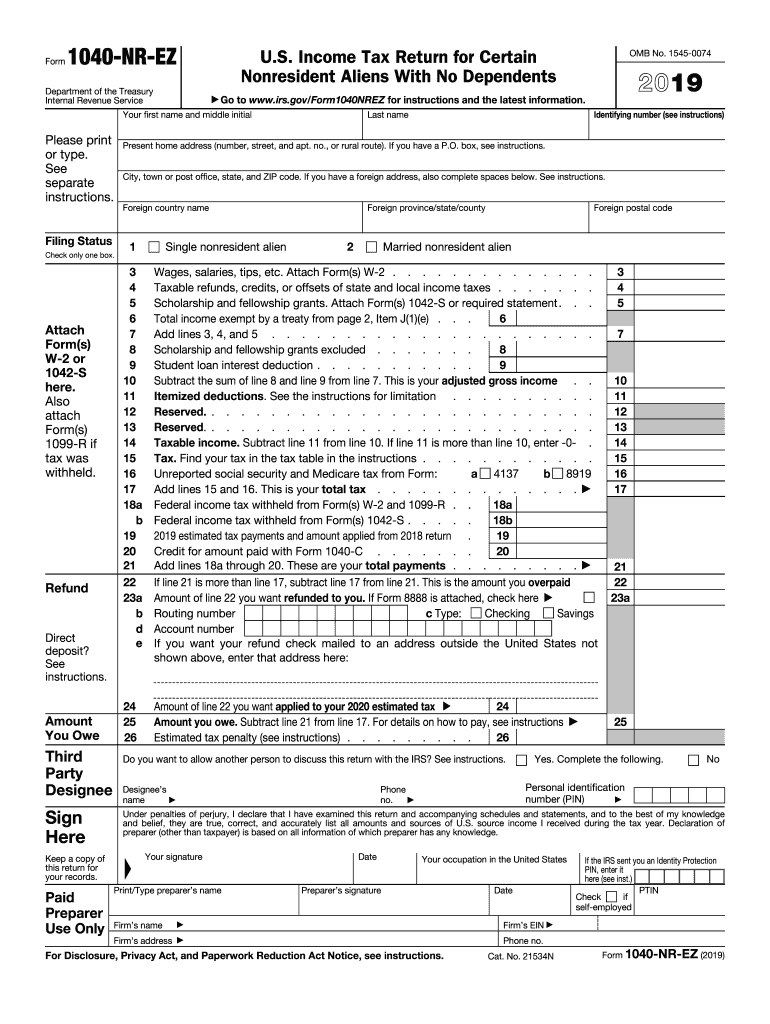

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

Form Recognizer W 2 Prebuilt Model Azure Applied Ai Services Microsoft Docs

1040 Vs 1040nr Vs 1040nr Ez Which Form To File 2022

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Cryptocurrency Taxation Here S What You Need To Know Cnn Business

Us Tax Filing Requirements For Canadians Irs Forms Us Tax Law

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Applying For A U S Tax Identification Number Itin From Canada Us Canadian Cross Border Tax Service Cross Border Financial Professional Corporation

Exit Tax Us After Renouncing Citizenship Americans Overseas

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Exit Tax In The Us Everything You Need To Know If You Re Moving